Tackle your data hurdles for CECL compliance

The new CECL accounting standard is forcing financial institutions to assess their current technologies and determine new ways to calculate loan losses. The new accounting standard applies to all banks, savings associations, credit unions, and financial holding companies.

What is CECL?

CECL or Current Expected Credit Losses is the new credit loss accounting standard, issued by the Financial Accounting Standards Board (FASB) to replace the current Allowance for Loan and Lease Losses accounting (ALLL).

Consensus in the banking industry is the Current Expected Credit Loss (CECL) method of accounting for loans will be the biggest change in the history of bank accounting. CECL will impact nearly every aspect of banking operations.

The biggest consideration is that no longer can financial institutions rely on the records of historical data to update their accounting records. Under the new standard, financial institutions will be required to use historical information, current conditions and forecasts expected credit losses to estimate the expected loss over the life of the loan.

Managing data using spreadsheet solutions presents challenges for CECL

At the center of achieving compliance is data collection, cleansing, and data warehousing to complete CECL calculations. Financial institutions by in large use spreadsheets to create financial reporting solutions. Yet, spreadsheets simply don’t have the bandwidth to process the volume of data, nor the functionalities to efficiently create a centralized CECL data hub.

There is an array of potential issues with using such a system that are Excel-based:

- Bandwidth limitations – The system required will need to house and process historical data up to 30 years in some cases, which is too cumbersome for spreadsheets.

- Laborious process – manually pulling data from multiple spreadsheets and source systems while troubleshooting and completing calculations is very time consuming, taking away from employees’ time to focus on more crucial tasks.

- Static data – The CECL system should have the capability to apply accounting and predictive models, but spreadsheets can only gather “point-in time” data references.

- Unreliable process – Using spreadsheet-based solutions opens the door to human errors, version control issues, open access and data corruption. An automated CECL solution provides restrictions on user access, content, versions, reports and much more.

- Verification limitations – During an audit, illustrating how your bank arrived at its allowance takes a long time to walk examiners through, via spreadsheets. An automated solution has pre-built auditing reports, with a verifiable trail to review users, calculations, and management adjustments at every step of the CECL process.

- Limited analysis capability – Spreadsheet solutions are limited in looking at risk rating migration or testing different methodologies under various scenarios. An automated CECL application will provide better management reporting and portfolio insights for quick decision making. Employees will spend less time querying data and have more time for analysis.

If you are still using spreadsheets to manage your financial reporting, you will need to advance your reporting technology to comply with CECL, ideally through an automated workflow system or customized software.

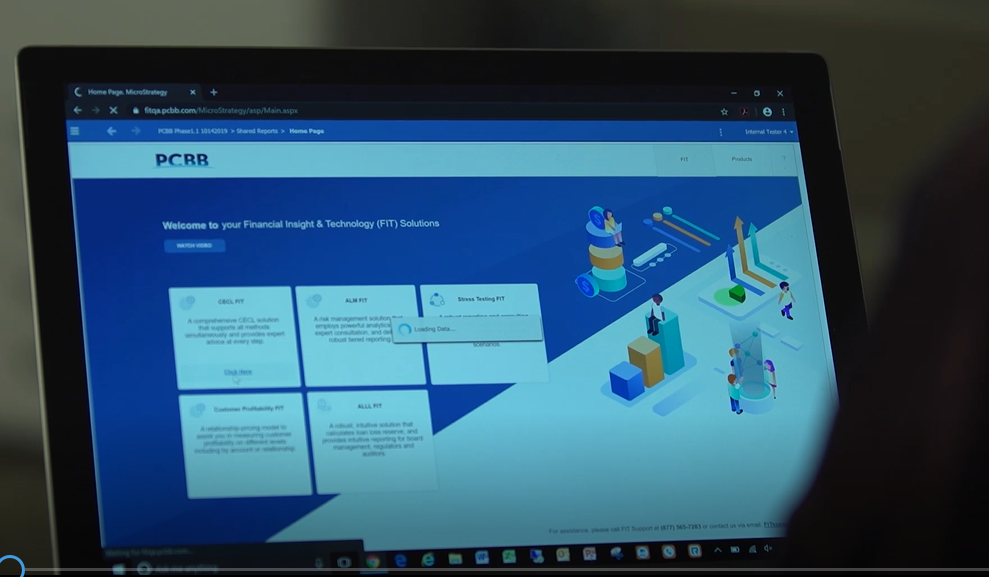

See how we worked with PCBB community bank to build their end-to-end CECL application in less than a year.

Data integration to forecast expected losses

Enhanced coordination between departments and functional areas is the most critical component to forecast expected losses. Each department has details about the status of the loan entity that is important, and once put together can tell a clear story or future expectations for the life of a loan.

Data integration helps to put the pieces together for this level of insight that is helpful to the loan cycle. Then, predictive analytics and forward-looking models will identify patterns in data, and analyze future performance through “What If” scenarios, and the impact of qualitative measures (like unforeseen natural disasters like Coronavirus) on the life of a loan or portfolio. In order to execute a deeper level of analysis, data management will be fundamental to this process.

Automate your financial reporting

Beyond CECL compliance, integrating data in a sophisticated platform has benefits. By moving your data into a system, you can automate your overall reporting processes, develop insights to make key decisions, distribute information securely to authorized stakeholders and provide client-facing dashboards for better customer service.

Leveraging our domain knowledge and experience, Analytics Intell helps all businesses transform their data from manual processes to an automated workflow process. After managing your data, we unlock the power of predictive analytics with forward-looking insights. These reports are then turned customized financial reporting solutions.

These forward steps in technology will help you become more competitive and starting to build the infrastructure for a Fintech company.